The Mobile Operator Innovation Map showcases how the world’s top operators are fostering, investing in and supporting innovation. After surveying and researching top operators from across the globe, we classified operator innovation efforts into four categories. Some operators are particularly strong in research, whilst others have great internal innovation cultures. Some are just great innovation allrounders

Related INSIGHTS

Explore the latest research and innovations in wireless, video, and AI technologies.

WHITE PAPER

Bridge to 6G: Spotlight on 3GPP Release 20

“Bridge to 6G: Spotlight on 3GPP Release 20”, authored by ABI Research and commissioned by InterDigital, explores how 3G...

BLOG POST

Addressing our Carbon Handprint with Sustainable Innovation

WHITE PAPER

Media Over Wireless: Networks for Ubiquitous Video

Media over Wireless: Networks for Ubiquitous Video explores the escalating demands and trends around consumer behavior f...

BLOG POST

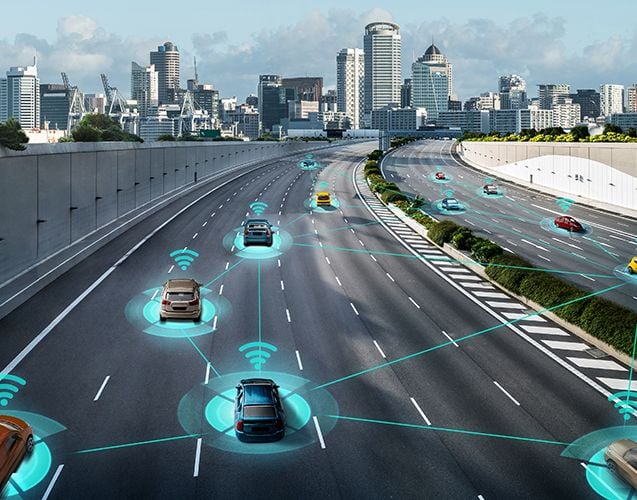

Driving the Future: ISAC’s Potential for Connected Vehicles

BLOG POST

Defining and Designing the Scope of 6G

BLOG POST