To research the future of the Internet of Things (IoT), Mobile World Live conducted an online survey of 393 people in the mobile industry – one of the largest IoT surveys to date - on behalf of InterDigital. The survey yielded a wealth of data, some of it confirming views and some challenging accepted views. That fragmentation and interoperability is a major issue is no surprise, and the industry is turning to four clear early standards leaders to provide a foundation. Perhaps in the same vein, and despite early indications that much of the IoT would be non-cellular, the ease of use and global nature of cellular is galvanizing attention. Finally, and surprisingly given the early talk of the tremendous benefits of IoT to primarily industrial economies, global respondents look to America as the early leader.

Related INSIGHTS

Explore the latest research and innovations in wireless, video, and AI technologies.

WHITE PAPER

Bridge to 6G: Spotlight on 3GPP Release 20

“Bridge to 6G: Spotlight on 3GPP Release 20”, authored by ABI Research and commissioned by InterDigital, explores how 3G...

BLOG POST

Addressing our Carbon Handprint with Sustainable Innovation

WHITE PAPER

Media Over Wireless: Networks for Ubiquitous Video

Media over Wireless: Networks for Ubiquitous Video explores the escalating demands and trends around consumer behavior f...

BLOG POST

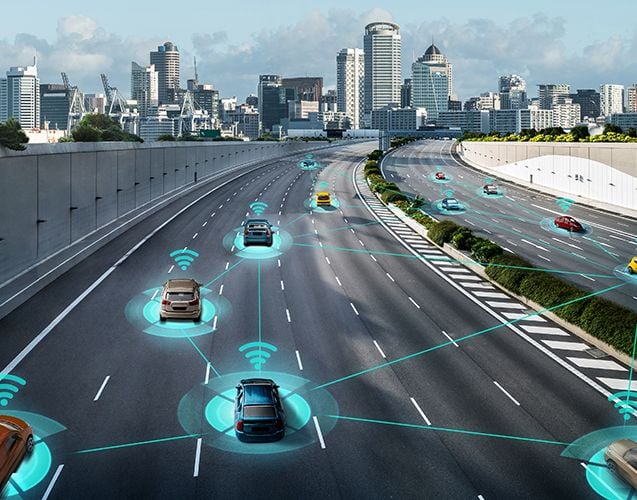

Driving the Future: ISAC’s Potential for Connected Vehicles

BLOG POST

Defining and Designing the Scope of 6G

BLOG POST