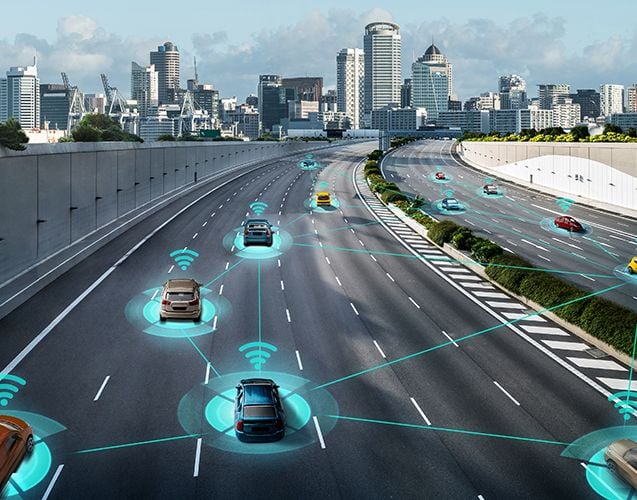

The global economy is experiencing rapid changes during the first years of the 21st century, with new technologies, concepts, and behaviors now changing the way we live and work. Blockchain, self-driving cars, Artificial Intelligence, and machine learning, Three-Dimensional (3D) printing, and Augmented Reality (AR) are just a few examples of technologies that hold the potential to create new markets and disrupt legacy businesses. At the same time, the world is experiencing increasing urbanization, with large cities continuing to act as centers of economic, technical, cultural, and social growth.

Related INSIGHTS

Explore the latest research and innovations in wireless, video, and AI technologies.

WHITE PAPER

Bridge to 6G: Spotlight on 3GPP Release 20

“Bridge to 6G: Spotlight on 3GPP Release 20”, authored by ABI Research and commissioned by InterDigital, explores how 3G...

BLOG POST

Addressing our Carbon Handprint with Sustainable Innovation

WHITE PAPER

Media Over Wireless: Networks for Ubiquitous Video

Media over Wireless: Networks for Ubiquitous Video explores the escalating demands and trends around consumer behavior f...

BLOG POST

Driving the Future: ISAC’s Potential for Connected Vehicles

BLOG POST

Defining and Designing the Scope of 6G

BLOG POST